-

Publish Your Research/Review Articles in our High Quality Journal for just USD $99*+Taxes( *T&C Apply)

Offer Ends On

Omehe Raphael*

Corresponding Author: Omehe Raphael, Department of Accounting and Banking and Finance Faculty of Management Sciences University of Delta, Agbor Delta state Nigeria.

Received: May 06, 2025 ; Revised: June 12, 2025 ; Accepted: June 15, 2025 ; Available Online: July 08, 2025

Citation:

Copyrights:

Views & Citations

Likes & Shares

The impact of financial market frictions on the growth of Nigeria's stock market is examined in this study. From 1985-2022, the model used the Ordinary Least Squares (OLS) approach to determine how different tax rates (capital gain, dividend, and transaction expenses) would affect stock market growth. Using the econometric program E-view 9.0, the analysis was carried out. The results show that capital gain tax considerably reduces the rate of stock market growth. However, dividend tax rates and transaction expenses are ineffective at the 5% relevant level.

According to the research, the financial frictions that hindered the development of Nigerian Exchange Limited throughout the studied period were represented by capital gain tax rates. If the current 10% capital gains tax rate is too high to encourage growth at the Nigerian Exchange Limited, a 25% cut is suggested.

Keywords: Capital gain tax, Dividend tax rate, Financial development, Financial market frictions, Transaction cost, OLS

INTRODUCTION

According to Adeleye, Osabuohien, Bowale, Matthew, and Oduntan [1], there have been major structural changes in several areas of Nigeria's financial system since 1986. These include the money market, capital market, and foreign currency market. The reason behind this is because enhancing financial development-which fuels economic growth-is directly tied to restructuring the banking sector. Investors in financial markets in developing countries should consider all the limitations of these markets to maximize their returns.

Various kinds of market frictions impact market advancement in different financial markets throughout the world, limiting the assets that market players and investors may choose from or own. For instance, according to Mech [2], there is a delay in the adjustment of prices toward equilibrium due to these financial market frictions, which cause news to be received and reflected in asset values at different times.

Disincentives to invest in financial assets can be caused by financial frictions, which are transaction expenses. To put it simply, friction is anything that gets in the way of free and easy trade and economic activity [3]. Friction in the financial markets refers to anything that makes it harder to trade efficiently. Everything that has an impact on the investor's decision-making process qualifies. Factors such as the investor's lack of familiarity with the product or the process for learning about it, various legislative and regulatory hurdles, taxes, and tedious tasks, such as waiting in line, can all impact the investor's choice [4]. There are frictions in the many financial markets since they all deal in trading assets. These frictions are more pronounced when it comes to specific assets traded in those markets. What this study did focus on, though, was the impact of stock market frictions on market development.

A number of stock market frictions have a disproportionate impact on economic production and consumption. Within the absence of stock market frictions, the expected return on investment (ROI) will almost always be equal to the fund's opportunity cost investment [5]. When frictions are present, however, the cost of obtaining outside funding is determined by the percentage of equity held by economic agents, defined as their net worth relative to GDP. In the capital market, intermediaries such as dealers and brokers help investors trade with one another.

On top of bearing direct expenses, these parties face competition from customers who may have more information, and they are demanding a price that is almost equivalent to the value of the transferred shares. The goal of this service charge is to cover the actual physical costs of trading and the impacts of adverse selection that reduce earnings. Because of their pervasive influence on nearly all stock market transactions, taxes and transaction fees serve as prime instances of market frictions. Any factor that increases the amount of time required to exchange a given quantity of an item for its optimal price might be considered a friction, as pointed out by Lippman and McCall (1986).

Prior research has focused on the effects of frictions on several economic indices. For instance, several studies have looked at how frictions affect stock returns [6,7]. Abdulganiy [8], for instance, looked at how financial market frictions affect portfolio investment choices and individual firm performance. Idolor, Oshadare, and Izedonmi [9] examined how frictions affect stock market performance. Ikponmwosa and Edo-Osagie [10] examined how frictions affect stock market efficiency. Aigbovo and Isibor [11] looked at how frictions affect stock market trading. Nothing in the prior study on Nigeria has looked at how frictions affect financial growth, particularly stock market development, as far as the researcher is aware. That void is what our research is trying to fill.

The following research questions are intended to be addressed by this study:

Literature Review

Conceptual Review

Concept of Financial Development

Cihak, Demirgue-Kunt, Feyen, and Levine [12] outline five essential financial functions that need improvement in their concept of financial development. Production and processing of investment evaluation data and capital allocation are among these functions. Following capital allocation, corporate governance is implemented, individuals and companies are monitored, trading, risk management, and diversification are made easier. Savings are collected and distributed, and the exchange of goods, services, and financial instruments is made easier.

In order to lower transaction and information costs, financial contracts, marketplaces, and intermediaries might arise throughout financial growth. this, in turn, promotes information acquisition, efficient financial transactions, liquidity transformation, and risk diversification, among other outcomes. For the sake of simplicity, let's define financial development as the sum of all the ways in which financial instruments, intermediaries, and markets work together to lower transaction, enforcement, and information costs. In order to improve the quantity, quality, and efficiency of financial intermediary services-which in turn encourage investment and growth Abdulganiy [8] defines financial sector development as the establishment and expansion of financial markets, instruments, and institutions.

By reducing the amount of asymmetric information, improving market levels, and enhancing agents' engagements in financial transactions, financial development is defined as the processes involved in achieving innovation and institutional/organizational advancements within a financial system [13]. The growth of the stock market as a component of the financial sector is the subject of this research. The study's measure for stock market development is the total value of transactions on the market.

Stock Market Total Value Traded: The formula to achieve this is to divide the total market value of all equities by the gross domestic product. When gauging the market's liquidity, two common ratios are total value traded and turnover. One way to gauge the health and activity of the stock market is to look at the value traded in comparison to GDP. This, in turn, suggests that share trading has improved in terms of quantity, frequency, and efficiency of trading, or that the stock market is more liquid.

The volume of stock exchanged, often called trading volume, is a measure of the number of shares that transfer between owners of a given stock [14]. Every day, the volume of a security might alter depending on the amount of new information about the firm that becomes accessible. The trading volume of a security may be defined as the total number of shares or contracts exchanged for that security. Volume of trade refers to the overall number of contracts or shares traded at a certain exchange.

Any and all commodities traded throughout a trading day can be used as a proxy for it, including stocks, bonds, futures contracts, options contracts, and anything else. We get this by taking the sum of all domestic and international share transactions, dividing it by the share prices, and then dividing the result by GDP. The aggregate transaction applies to all securities traded on the Nigerian Exchange Group.

Financial Market Frictions

Financial market frictions are elements that demonstrate the difficulty of trading an item on a financial market, as demonstrated by a charge or a time frame, according to Stoll [15]. He went on to say that since they influence almost every transaction, taxes and transaction fees are prime instances of market frictions. A financial friction occurs when there is a mismatch between the rewards obtained by consumers who provide financial capital and the costs incurred by enterprises and consumers [16].

Imperfections in the market are characteristics that go counter to the fundamental principles of impact market theories, as stated by Poyry [17]. He compares them to frictions. According to Andler [3], friction is anything that gets in the way of free and easy trade and economic activity. Stock frictions are the primary emphasis of our research.

Frictions in the Stock Market

It is possible to divide the realms of financial market frictions in several ways. And therefore, just as many versions exist as there are scholars. Our attention will be drawn to the categorization offered by DeGennaro and Robotti [4] though. Foundational to the structure of financial market frictions are the economic processes that underpin them. Further, this framework is heading in the right way in terms of finding out which companies can reduce market friction costs the best. Using five primary categories, DeGennaro and Robotti [4] classify transaction costs, taxes and regulations, non-traded assets, asset indivisibility, and agency and information concerns. Among the many issues plaguing the buying and selling processes, financial frictions are highlighted by Olbrys and Majewska [18].

Transactions costs: In their 2007 study, DeGennaro and Robotti [4] classified transaction costs into two broad groups: trade costs and opportunity costs of time. Financial market trading costs money, which may be represented by items like mail, phone fees, computer power, and similar actual resource payments. Because of developments in technology, they have been declining. Even while these expenses may have increased in actual terms at various times in time, the price of data analysis and communication has decreased. Consider the utterly free nature of sending an email. There has been a reduction in the price of nearly all mechanical costs associated with trade as well.

One example of an opportunity cost is the time spent searching for relevant information (such as a trade partner) and another is the time spent actually closing the contract. Saving money is possible by cutting these costs. Using technology like automated electronic payments to automate the procedure is one possible partial solution.

Dividend reinvestment plans are one kind of investment vehicle that allows investors to directly retain shares and have their dividends reinvested. Regardless of the scenario, investors are only need to take a single action in order to make several investments over an uncertain and perhaps extremely lengthy duration. Given that the potential cost of time often increases with time and the time needed to trade will obviously decrease further as technology progresses, it is expected that this gap will widen.

Of all the frictions in the financial markets, transaction fees are among the most well-known. However, in the present day, they may also rank among the least significant. Both the time and money needed to complete a deal have been drastically cut down because to developments in communication and data-handling technologies in recent years. A rise in the opportunity cost of time would likely be more than compensated for by these factors taken together. For example, according to Vayanos [19], the frequency of portfolio rebalancing is the primary factor impacted by genuinely minor transaction costs, whereas the impacts on asset returns are minimal.

Taxes and regulations: Taxes and regulations are the second main class of financial market frictions according to the taxonomy of DeGennaro and Robotti [4]. In its broad definition, "regulation," they include both formally established laws and more informal guidelines set out by various governmental and private entities. Consequently, regulations include privately imposed restrictions like trading rules set by an exchange. Explicit or implicit taxes and regulatory expenses are possible. There is no ambiguity about the corporate income tax; both the tax legislation and the money sent by corporations to the government identify it as a tax. Implicit taxes also exist, for example, insured banks have capital requirements that they must fulfill [20]. Here, neither the legislation enabling the capital requirements nor the banks' actions constitute taxes, and the government is not relieved of its duty by receiving these sums. Still, these mandates function similarly to taxes in that they drive up the cost of conducting business. Every jurisdiction has its own unique set of regulations.

Asset indivisibility: In an endlessly divided world, investors might possess a tiny fraction of every asset. The market portfolio of all investable assets would be accessible to all investors, regardless of their financial situation, using this strategy. Regardless, assets aren't perfectly flat and have a finite minimum trading unit. That leaves the majority of investors with the choice of adding or excluding the most fundamental asset unit from their portfolios. Since their investments will differ from the market portfolio in terms of percentages, their ultimate portfolios will be less than the capital market line.

One major rationale for the existence of mutual funds and derivative instruments is the indivisibility of assets. The idea is that by combining the money of many people, they may create a portfolio that is more similar to the market. Unfortunately, due to the high expense of the operation, some indivisibility persists.

Non-traded assets: Assets that are either difficult or impossible to exchange are considered non-traded assets. Someone who spends tens of thousands of naira on schooling and training cannot, for instance, turn that investment into a monetary asset. However, the scope of what may and cannot be traded is ever-expanding due to the ongoing innovation in the financial industry. The rising popularity of securitization-a procedure where investors acquire interest payments from mortgages or credit card debt-is an example of the inventiveness demonstrated by financial institutions and their workers in addressing the difficulties associated with non-traded assets.

The idiosyncratic risk is mitigated by bundling the assets. In certain cases, new technology allows for the separation of risks associated with assets and their sale to investors with more financial capacity to handle them (such as credit-default swaps). However, this does not imply that all market friction disappears the moment an asset is transferred. It is more appropriate to say that the friction has been reduced or replaced by another, hopefully less severe, form of friction. One glaring issue with human capital sales is the potential illegality of selling some rights on future revenue. The issue of an item not being exchanged is made more complicated if that legal restriction-here, a regulatory financial market friction-is not lifted. Indeed, financial market frictions can affect traded assets as well. Conflicts of interest, often known as agency problems in economics, are another problem with selling human capital [4].

Agency and information problems: The matter of motivation is addressed by agency and information difficulties. Although the idea has been around since Adam Smith (1776), the groundbreaking study in this field was written by Jensen and Meckling [21]. It is unreasonable to expect directors of big corporations to be as careful with another people's money as they would be with their own, as pointed out by Smith. He elaborates by saying that carelessness and wasteful spending follow. An old saying goes something like, "If you want the job done right, then do it yourself." Smith's wisdom is in line with this saying. The catch is that it's not feasible to do it yourself for any company larger than a certain size. scale invariably leads to a split between ownership and control since few individuals can afford to own a whole firm and no one can manage a corporation of any scale without bringing in agents to assist him. When money and power are no longer held together, what problems arise in the financial markets? There is no free lunch when it comes to financial contracts, and the split might lead to incentive problems.

It may make perfect sense to purchase an item that is already owned by someone else, but some investors are afraid to part with their own money or assume the seller knows better about the dangers involved with the asset than they do.

Theoretical Review

Trading cost theory

Developed in 1986 by Amihud and Mendelson [6], this concept investigates the costs of stock trading. Considering actual market frictions is important for estimating asset values as these factors influence both trading and asset valuations. According to Amihud and Mendelson's [6] research on the effect of transaction costs on stock prices, equities with larger bid-ask spreads produced better returns.

Another thing they proved was that transactional expenses might go up or down depending on the time of year. As a result of transaction costs, the market becomes fragmented, with short-term investors holding equities that are somewhat more liquid than long-term investors. Although the majority of investors can choose not to buy equities that have a high transaction cost, Transaction costs and expected stock returns are positively concavely related, say Amihud and Mendelson [6]. Stockholders who hold onto their investments for longer can reap the benefits of illiquidity, which outweigh the expected costs of transactions, by buying shares with larger spreads. As a result of their increased trading activity, investors whose holding durations are shorter are more likely to incur expenditures than those whose holding periods are longer. Those that invest over the long haul can write off transaction costs as they accrue.

In addition, certain investors are very substantial compared to others, to the point where they may affect market prices-either because of their size or the benefit of the knowledge they possess. Every time he deals with knowledgeable traders, the market maker ends up losing money. To compensate, they need to find ways to take advantage of the uninformed traders. What gives rise to these profits is the bid-ask spread. Broader bid-ask spreads, caused by more severe information asymmetries, suggest that the market is less liquid. Ding, Nilsson, and Suardi [22] found that rational market makers set bid and ask prices correctly, demonstrating competitiveness. A perfect market would have all participants present simultaneously.

Since this is the case, every consumer may instantly reach any vendor in the market. Nevertheless, in a practical sense, this is not accurate. Participation in the market comes with expenses for agents, such as the cost of tracking market movements. On top of the expenses associated with participating in the market, agents also have to pay to have each transaction executed. Transaction expenses significantly impact the capital appreciation or depreciation of an asset. Stock market trading is affected by transaction expenses, which include brokerage fees, order processing fees, and transaction taxes. Atkins and Dyl [23] classify certain transaction costs as basic transaction costs, whereas others, such transaction taxes, are induced by other market imperfections.

Both the seller and the buyer are affected by the trader's profit, which is directly affected by the aforementioned expenditures. One way to look at these costs is as a component of market trading; they affect the price at which investors trade, which reflects the reality that stock markets have frictions. According to Atkins and Dyl [23], markets where transaction costs are high are not as liquid as those where these costs are low.

Agency Theory

Incomplete contracts, according to agency theory, will lead to disputes and agency costs. But when managers' and shareholders' goals are at odds with one another, an agency problem emerges. Since the manager isn't looking out for the shareholders' best interests, this might happen. Jensen and Meckling [21], Easterbrook [24], and La Porta, Lopez-de-Silanes, Shleifer and Vishny [25] all state that agency theory presupposes that the relationship between shareholders and management is an agency one. Management and stockholders are certain to have competing interests. The former wants to amass as much wealth as possible, whereas the latter aim to earn as much money as possible. Management often takes measures to reassure shareholders in order to reduce the likelihood of dispute amongst them. Managers' actions change depending on whether they control all of a company or only a portion of it [21]. Executives who do not own all of the company's shares are more likely to act selfishly, prioritizing their personal wealth over that of shareholders. "Residual loss" was the term used by Jensen and Meckling [21] to describe the financial impact of this agency problem. Also, they coined the term "agency cost" to describe the money and effort needed to keep tabs on their agent's business. Managers have an obligation to act in the best interests of their principles, even if their personal interests are at odds with those of the owners (principals). Profit sharing, thirteen months, and dismissal are some of the mechanisms put in place to ensure that managers' interests align with those of owners and to discourage the development of an empire. The split between ownership and control causes friction in the market since it makes incentive problems that a financial contract can't fix for free.

Empirical Review

In this review, we survey the works written about the effects of financial market frictions on economic growth. This section mainly reviewed pertinent research, which looked at how financial market frictions affected other economic aggregates, because there is a lack of literature on the subject. For instance, Amihud and Mendelson [6] investigate whether stock gains fairly reflect the effect of market frictions on the US. They found that investors with longer time periods might possess non-liquid assets by utilizing the bid/ask spread as a measure of liquidity (friction) and the Fama & MacBeth (1973) process of portfolio creation. This was due to the fact that returns and transaction costs formed a concave and growing function.

Additionally, they found that when liquidity levels increased, risk-adjusted returns fell. New York Stock Exchange studies conducted by Barclay, Kandel, and Marx [26] found no statistically significant correlation between transaction costs (also called friction) and stock prices.

Hou and Moskowitz [7] analyze how price delays and market frictions affect various expected returns. The results show that small, unpredictable, and underused stocks have a significant lag. They draw the conclusion that understanding the cross section of returns requires considering enterprises that encounter substantial friction. There is a clear return premium in the cross-section for delayed enterprises that is larger than the organization size, even after accounting for microstructure and liquidity effects.

When it comes to capital flows, trade flows, and economic development, Bougheas and Falvey [27] dissect the effects of financial market frictions. Weak institutions and an abundance of agency fees in the financial markets prevent economic specialization in finance-related industries, according to the report. Countries with more robust financial systems, on the other hand, are better equipped to tap into capital markets and expand sectors that rely on them.

In their 2010 study, Yafeh, Ueda, and Claessens [28] analyze the impact of institutions on financial frictions using a panel of 75,000 firm-years spanning 48 nations from 1990 to 2007. Regression results show that better corporate governance (i.e., fewer informational problems) and enhanced contractual enforcement are more effective in lowering financial frictions than stronger creditor rights (i.e., less limits on collateral).

Research by Kasimu [5] looks at the years 2012-2016 to determine how financial market frictions affected investment portfolio decisions, business performance, and the global economy. The study covers nations that are both developed and developing.

Specifically, this study uses panel least square and two stage least square estimation techniques to analyze data and test hypotheses. A research found that financial market frictions, as well as variations in these frictions across various financial markets, have a considerable impact on investment portfolio selections and performance at the firm and national economy levels. According to the research, variations in currency rates and other financial market frictions have a substantial impact on investors' decision-making and performance. Frictions in the financial markets impact portfolio performance and investment decisions across all markets.

The relationship between China's political ties and commercial issues is explored by Deng, Zeng, and Zhu [29]. They found that Chinese businesses aggressively pursue political ties in an effort to lower the costs of market frictions. Their findings also show that financially strapped businesses aren't as bad as previously thought, even when dealing with major market frictions. They do, however, discover that market frictions in terms of financial limits mostly impact Chinese enterprises with minimal political influence.

The impact of market frictions on the performance of the Nigerian stock market from 1981 to 2018 was investigated by Idolor, Oshadare, and Izedomi [9].

Several market friction variables were utilized in the study, including transaction cost, asset indivisibility, nontrade assets, taxes and regulations, and agency with information problem. These variables were used to represent different aspects of the market, such as the total value of market transactions, the value of sold equity, the value of mutual fund transactions, the value of bonds and other instruments, and the cost of transactions. Results from the ARDL regression showed that stock market growth was positively affected by all of the study's financial market friction factors. Capital market expansion was also affected by transaction costs, agency, and information difficulties, but not by tax and regulatory rates, non-traded assets, or market indivisibility.

Using data from 2007-2017, Wang, Lei, and Zhao (2021) examine the effects of financial friction on TFP and resource misallocation in China. First, mathematical models are constructed to help understand how resource misallocation works and what consequences it has. The models show that when there is a mismatch between available resources and financial friction, total factor productivity (TFP) falls. Second, for this study, the researcher used the Chinese dataset to build econometric models that examine how financial friction affects resource allocation and total factor productivity. The results of the regression analysis demonstrate that total factor productivity in China is negatively impacted by financial friction. In addition, friction in the financial markets will lead to factor distortion. Misallocation of resources is also a major channel, according to the results of the mechanism study.

In their 2021 study, Ikponmwosa and Edo-Osagie [10] look at the effect on stocks of the announcement of a stamp duty rate increase in Nigeria. A first trading day following the announcement was December 7, 2020, which occurred on December 5, 2020. There was a downward trend in stock returns trading ten (10) days following the announcement, according to the empirical data. Sixty firms' daily stock price series were analyzed using the usual event research approach. When the cumulative abnormal return (CAR) was -1.16% ten days after the release, and the abnormal return (AR) was -1.51% on the first trading day after the news, it was clear that the stock market was reacting negatively.

Uhunmwangho and Ogieva [30] investigated the possibility of regulatory frictions (monetary policy rate) at the Nigerian Exchange Limited from 2010 to 2019. Because of the market index's inherent autocorrelation, the results reveal market frictions. Financial policy rates have a favorable and statistically significant effect on market indexes, as shown in the study.

In their 2021 study, Uhunamure and Uhunmwangho [31] look at the effects of financial market frictions on the performance of the Nigerian stock market. From 2010-2021, researchers focused on the effects of regulatory frictions, asymmetric information, and transaction costs. A dynamic model was subjected to the Generalized Method of Moments in order to examine the impacts. Legal hurdles, transaction fees, and information asymmetry all play major roles in determining stock market results, according to the results. Specifically, returns are significantly and favorably affected by the cash reserve ratio, whereas market returns are significantly and adversely affected by the lending rate. Although market volatility and exchange rate volatility have large negative effects on stock market returns, market illiquidity and traded volume have large favorable effects. Rules, asymmetric knowledge, and transaction costs comprise what this study claims to be. Aigbovo and Isibor [11] studied the NSE's trading behavior in relation to financial market frictions from 1981 to 2019. Market frictions were analyzed taking into consideration both tax-based factors and direct market costs of trading. Dividend and capital gains tax rates were used to isolate tax-based frictions, which strengthened the analysis. To measure the immediate and distant consequences of the study's custom-built dynamic strategy, researchers employed an autoregressive distributed lags (ARDL) model. The research shows that commerce on the Nigerian Bourse is frequently significantly affected by tax-related frictions. To be more precise, dividend taxes reduce trading activity while capital gains taxes raise it. However, it was demonstrated that direct trade transaction costs had no.

METHODOLOGY

Due to the time-varying nature of the variables under investigation, this study employed a longitudinal research strategy. Focusing on the years 1985-2022, this research seeks to analyze how financial market frictions impacted the growth of the Nigerian stock market via the lens of the Nigerian Exchange Limited. This research looks at the following variables-the growth of the stock market, total transaction cost, the rates of capital gains and dividends-using only secondary time series data. In particular, the data came from the CBN's Statistical Bulletin (2022). Adopting the Ordinary Least Squares (OLS) technique on the time series model, we investigated how transaction fees and taxes affected the expansion of the Nigerian stock market.

Theoretical Framework

The trading cost hypothesis put forward by Amihud and Mendelson [6] forms the basis of this investigation. Taxes on transactions, fees for processing orders, and brokerage fees are all examples of trading-related expenses that, according to the null hypothesis, impact stock market growth.

Model Specification

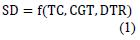

The model is derived from the one created by Idolor [9], with some small modifications made to account for the financial market friction factors included in this study. Agency with information difficulties, nontrade assets, asset indivisibility, transaction costs, and taxes and regulations are the financial market frictions that their model uses as proxies.

We used the overall transaction cost, the dividend tax rate, and the capital gain tax rate to model the financial market frictions. Consequently, we determined the whole market value of traded stocks by integrating the overall cost of transactions, dividend tax rate, and capital gain tax rate.

Here is how to log-linearize Equation (1) and convert it into an error-term econometric time series model:

Where; SD: Stock Market Development; TC: Total Transaction Cost; CGT: Capital Gain Tax Rate; DTR: Dividend Tax Rate; Ln: Natural logarithm; f: functional relationship; a0: Intercept; a1-a3: Model parameters (coefficients of each explanatory variable); ɛt: Error term

A priori expectation as derived theoretical literature is express as; β0> 0 and β1, β2, β3 < 0. Meaning that, all the explanatory variables are anticipated to negatively influence financial development (stock market development).

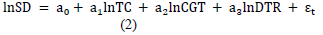

Variables Measurement

Table 1 defines the variables used, as well as the a priori expectation.

Methods of Data Analysis

Methods from descriptive and inferential statistics are employed to arrive at data estimates in this study. A more succinct presentation of the results of an investigation into the properties of variables is possible with the help of descriptive statistics. Correlation analysis may reveal the nature and degree of the relationship between variables. Additionally, it enables the research to confirm if the model's variables exhibit multi-co-linearity. By utilizing the ordinary least square (OLS) methodology to ascertain the impact of financial market frictions on stock market development, this study ultimately came to findings about the inferential statistics method.

DATA PRESENTATION AND ANALYSES

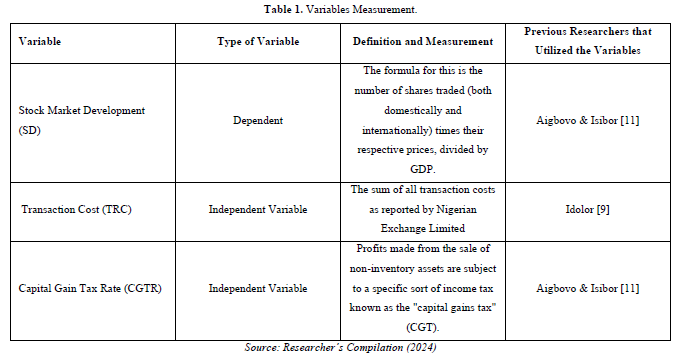

Descriptive Statistics

To identify the characteristics of the data set used for this study, descriptive statistics were necessary. In Table 2 we can see the aggregate statistics of the variables that were used to look at how financial friction indicators affected the growth of Nigerian Exchange Limited from 1985-2018.

To emphasize how different the variables are from one another, we present their descriptive statistics in Table 1. In Table 2, we can see that from 1985 to 2022, the average stock trading volume (a measure of stock market development; SD), total transaction value (TC), capital gain tax rate (CGT), and dividend tax rate (DTR) were 24065.69, 43.59, 0.09, and 0.11 years, respectively. The vast disparity in size between the variables raises the possibility that the results are distorted due to estimation errors in the levels. While TC and DTR were found to be negatively skewed, the results indicate that SD and CGT were positively skewed. Since DTR's probability is not deemed statistically significant at the 5% level, it did not adhere to a normal distribution when compared to the other variables, as per the Jarque-Bera statistics. The other variables, on the other hand, did indeed follow normal distributions.

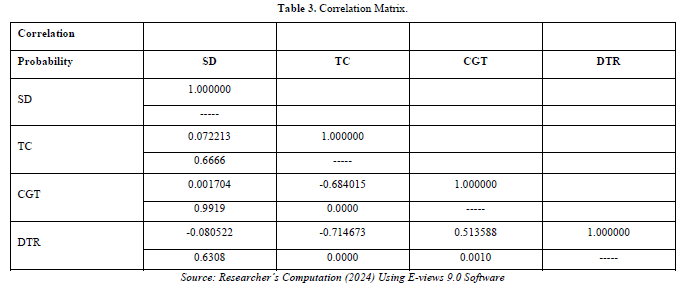

Correlation Analysis

It is crucial to do preliminary research on the direction and degree of correlations between study variables. Some of these probes rely heavily on correlation analysis. In Table 3, you can observe the results of the tests for correlation.

Table 3 reveals a small but positive association between TC and FD, but it is not statistically significant. According to the positive coefficients for these variables, a growth in SD over the study period is modest and inconsequential. The positive correlation between CGT and FD is minor and not statistically significant. Based on the related negative coefficients, it can be inferred that an increase in CGT throughout the analyzed period had a mild and non-significant effect on SD. Thus, an increase in DTR will only mildly and insignificantly decrease SD. In addition, as mentioned by Gujarati (2008), there is no multi-co-linearity problem among the explanatory variables in table 3, as no correlation coefficient is more than 0.80.

Testing for Unit Root

The conventional wisdom holds that data sets spanning several years are not steady, since the means and variances may exhibit some degree of instability over time. If this is the case, the results of any regressions run on that dataset could not be trustworthy. Therefore, to find out if the variables are stationary or not, we ran Augmented Dickey Fuller unit root tests on them at various levels, and the results are in Table 4.

All of the variables in Table 4 do not exhibit level stationarity because, at the 5% level, their critical values are lower than their corresponding ADF statistics. The inference is that the integration of these variables is not of order 0 (0). This led to a rerun of the ADF processes on the variables, this time focusing on the first difference. According to the outcome, all of the variables stabilized at their initial difference, which suggests that they are integrated of order one (1). In accordance with the study's findings, the variables do in fact possess a unit root at first difference. So, you can trust the variables to provide you reliable regression results.

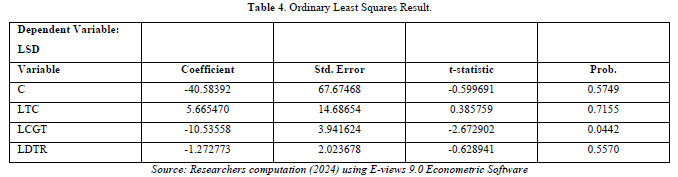

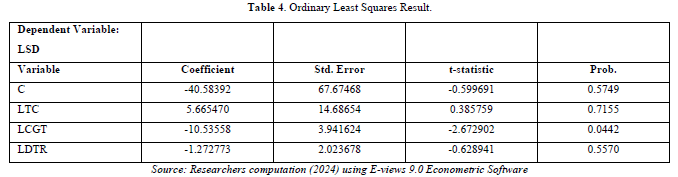

Regression Analysis

By analyzing the Nigerian Exchange Limited, this study sought to understand the impact of financial market frictions on the expansion of stock markets. The findings are displayed in Table 4, which was generated by employing the ordinary least squares regression method for the investigation. This dependent variable's systematic variation is explained by the explanatory variables to the tune of 56.76 percent, as shown by an R2 of 0.729762 and an adjusted R2 of 0.567620. One way to evaluate the accuracy of a regression model is by looking at its R2 value. The validity of the regression result is inferred from this. A 5% level of significance yields an F-statistic of 4.50 with a corresponding probability value of 0.059431, demonstrating the model's explanatory potential. It proved, in a nutshell, that the independent variables work together to influence the dependent variable. Accordingly, three explanatory variables-LSD in the Nigerian stock market, LCGT, and LDTR-contribute significantly to LSD when taken together. If regression results show serial correlation, it might mean the estimate isn't reliable enough to use for policymaking. Using the Durbin-Watson statistic in Table 4, we checked for autocorrelation to ensure that the regression outcome of this study is not inflated. With a Durbin-Watson value of 1.820424, the regression findings clearly do not indicate serial correlation. The study finds that the regression is suitable for policy direction as it satisfies all the diagnostic criteria. This allowed the research to proceed with interpreting Table 4's regression result.

Table 4 indicates that stock market development (LSD), as determined by the volume of stocks traded on the Nigerian Exchange Limited (NSE), was significantly impacted by the Capital Gain Tax Rate (LCGT), a measure of financial market frictions. This impact has a probability value of 0.0442. However, the dividend tax rate (LDTR) and LTC have little bearing on the evolution of the stock market. In contrast to the a priori expectation, the total amount of transaction cost (LTC) was mistakenly reported as positive, although it failed the significant test. On the other hand, the LCGT and LDTR were appropriately negative for capital gain and dividend taxes. Therefore, the theoretical expectation was met by these two explanatory factors. Coefficients showing a negative association between capital gain tax (LCGT) and dividend tax rate (LDTR) suggest that a decrease in stock trading activity in the Nigerian stock market would result from an increase in either of these independent variables. Therefore, it may be concluded that financial market frictions, here represented by the capital gain tax rate (LCGT), significantly impede the expansion of the Nigerian Exchange Limited, which serves as a proxy for the volume of shares traded there.

DISCUSSION OF FINDINGS

Only the capital gain tax rate (LCGR) has a major influence on the expansion of the Nigerian Exchange Limited, despite the fact that both the dividend tax rate and the capital gain tax rate meet a priori assumptions. This result supports the hypothesis that financial market frictions, such as the capital gain tax rate, or LCGR, hampered stock market expansion during the period under review, particularly the growth of the Nigerian Exchange Limited. According to Aigbovo and Isibor [11], the capital gain tax rate (LCGR) significantly reduces the share exchange volume. This conclusion is consistent with their findings. This study demonstrates that the capital gains tax rate has to be reduced since it significantly hinders Nigerian Exchange Limited's ability to expand. The market has an impact on how Nigerian Exchange Limited regulates financial market frictions, as evidenced by the non-statistical significance of transaction costs and dividend tax rates.

CONCLUSION AND RECOMMENDATION

The goal of the project's research team was to ascertain how financial market frictions affected Nigeria's stock market's expansion. Ordinary Least Squares (OLS) was used to evaluate the model between 1985 and 2022 in order to ascertain how the capital gain tax rate, dividend tax rate, and transaction cost affected the evolution of the stock market. The econometric application E-view 9.0 was used to perform the study. The findings indicate that capital gains tax has a detrimental influence on the stock market. However, the dividend tax rate and transaction cost fail the significant test at the 5% threshold. According to the analysis, one of the major challenges Nigerian Exchange Limited had during the period under review that impeded its growth was the capital gain tax rate. The current 10% capital gain tax rate is too high and is holding down the growth of the Nigerian Exchange Limited. A reduction to 2.5% would be ideal.

Nigeria has been the sole subject of the study. Therefore, it would be beneficial to undertake such a research for every sub-region in Africa or for all of the nations in sub-Saharan Africa. The study's policy implications may be limited to Nigeria due to its conclusions' reliance on that country's specific environment. Therefore, future studies in this field, particularly those involving African nations, should use a panel data technique or conduct cross-country investigations. Insights on the impact of governance and regulatory quality on stock market performance across African nations would be useful for policymakers.

No Files Found

Share Your Publication :